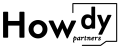

Where to Buy Reliable Hoek Cell Urethane Rubber Sleeves for Rock Testing Labs

I’ve bought sleeves that made tests easy—and some that ruined a week. The difference was always the supplier.

Pick suppliers with proven batches, clear specs (thickness, Shore A, oil compatibility), clean QC documents, and responsive support. Verify with samples and a small qualification run before any big order.

Let’s cover reliability, pre-buy checks, buying channels, and a calm, step-by-step evaluation plan.

What Makes a Supplier Reliable?

A reliable supplier is predictable: consistent batches, fast help, and paperwork that matches the product you receive.

Look for repeatable thickness, tight hardness tolerance, documented oil/water compatibility, pressure ratings, and batch traceability with real contactable references.

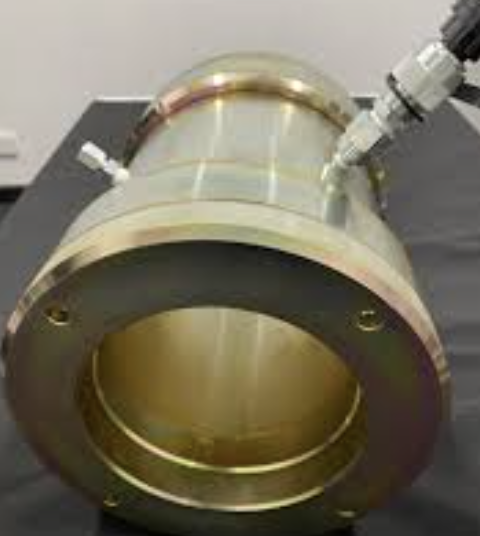

When I audit a sleeve supplier, I start with consistency. One great sample is luck; three good batches are a system. I ask for thickness and Shore A records1 across multiple points, plus the cure profile and resin lot. If their QA sheet can’t trace a sleeve to a batch and a date, I slow down. Next is compatibility: Hoek cells often run oil or water; some urethanes swell in certain oils. I want a swelling/weight change table2 and a short immersion report at test temperature. Bonus points for a pressure hold test on a dummy core showing no blistering or creep.

Support matters. In real labs, things tear, timelines slip, and we need answers. I test response time with a pretend order change and a technical question about membrane stiffness; slow, vague replies are a red flag. Packaging also tells the truth: sleeves should arrive dust-free, UV-shielded, with size labels by inner bag. A good supplier will share an installation note and O-ring pairing guide; that reduces our early failures. Finally, I ask for two references I can actually call. If they hesitate, I listen to that feeling. A practical scorecard helps—download my supplier score sheet here and a sample QA request list here.

Reliability scorecard (starter)

| Criterion | What “good” looks like | Weight |

|---|---|---|

| Batch consistency | Thickness SD ≤ 0.03 mm; Shore A ±3 | 30% |

| Compatibility docs | Oil/water swell ≤ 3% @ 24–72 h | 20% |

| Traceability | Batch/lot, cure date, material lot | 20% |

| Support speed | ≤ 24 h meaningful reply | 15% |

| Packaging/labels | UV bag, desiccant, size/lot on bag | 15% |

What Should You Check Before You Buy?

Small checks now prevent failed envelopes later. Paper + samples + a short bench test beat brochure promises.

Request size chart, thickness map, Shore A data, oil/water swell test, and sample sleeves. Then run a 3-step confining hold and one sacrificial ramp.

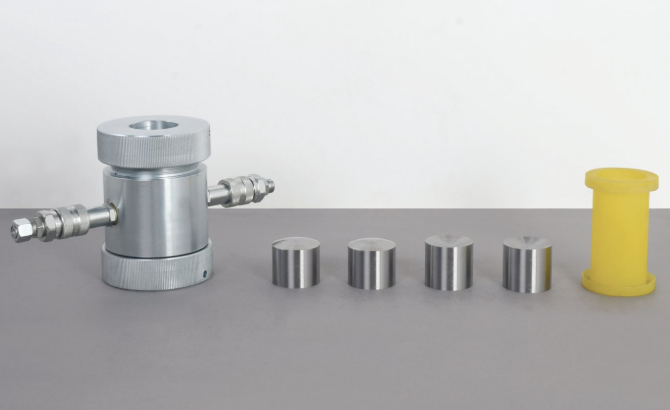

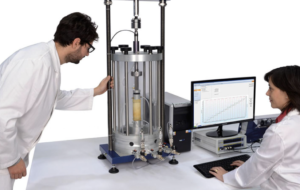

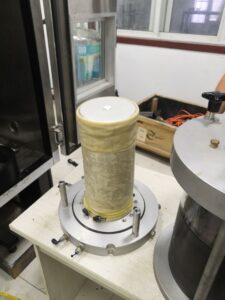

My pre-buy ritual is simple. (1) Paper check: ask for a spec sheet3 with nominal thickness, tolerance, Shore A, recommended O-ring sizes4, and temperature window. Add the compatibility page for the fluids you use. If they can’t provide it, that’s a pause. (2) Sample check: request 6–10 sleeves from two batches. Measure thickness at six points per sleeve with a micrometer; log mean/SD. Do a quick shore hardness reading if you have a durometer. (3) Bench test: mount a dummy core with the sleeve and your usual caps. Run a low-pressure hold at ~0.2 MPa for 5 minutes, then step 0.5→1.0→2.0 MPa, holding 2 minutes at each step; watch Δp and any weep. Finish with one ramp to your typical σ₃ (e.g., 10–20 MPa) to surface hidden defects.

I also do a mini chemical soak: slice a sleeve ring, weigh it, soak in your confining fluid at lab temp, re-weigh at 24/72 h, and record mass change. If swelling is >3% or it clouds, I don’t proceed. Check fit: the internal diameter should be about 1–3% smaller than the core. Too loose and you get wrinkles; too tight and you pre-stress the specimen. Document everything. Use my pre-buy checklist here and a one-page bench protocol here.

Pre-buy checklist (abbrev.)

| Item | Pass cue |

|---|---|

| Spec + tolerance sheet | Thickness/Hardness shown |

| Compatibility table | Your fluid listed |

| Sample sleeves (2 lots) | Received & labeled |

| Hold/ramp test | Δp ~ 0; no weep |

| Swell test | ≤ 3% 72 h |

Where Can You Buy? (Channels & Shortlists)

You don’t need one perfect store; you need two dependable channels and a backup plan.

Use three paths: direct manufacturers, lab distributors, and custom urethane shops. Shortlist by core sizes, pressure range, and documentation quality.

I build a two-supplier strategy5: a primary for routine orders and a secondary for rush or special sizes. First, check direct manufacturers6 focused on geotechnical consumables; they usually carry common diameters (25–54 mm) and publish tolerance data. Second, lab distributors bundling triaxial consumables can simplify logistics—one invoice for sleeves, O-rings, and caps—but you must still audit their upstream batches. Third, for unusual diameters or long lengths, a custom urethane shop can mold to spec; expect a small tooling fee and minimum order.

When shortlisting, align diameters (e.g., 25/30/35/38/50/54 mm), thickness options, and Shore A ranges with your pressure envelope. Ask whether they stock oil-friendly formulations and what the standard lead time is. A good vendor will send a size chart and O-ring pairing table without drama. Keep a simple spreadsheet to compare: price per sleeve, MOQ, lead time, shipping method, and documentation. Then run the same bench protocol on two vendors and let the plots pick the winner. Templates: shortlist sheet here, vendor email draft here, and a reorder reminder card here.

Channel snapshot

| Channel | Pros | Watchouts |

|---|---|---|

| Direct manufacturer | Best spec depth; steady batches | MOQs; lead times |

| Lab distributor | One-stop ordering | Upstream batch changes |

| Custom urethane | Odd sizes, tailored hardness | Tooling cost; NRE, longer setup |

How Do You Evaluate Samples and Finalize Supply?

Test like you’ll run production: same caps, same lube, same holds. Decide with data, not hope.

Run a five-specimen trial across two σ₃ levels. Track hold drift, tear rate, install time, and early stiffness (membrane effect). Pick the calmer plots.

I use a pilot batch7 of 20–30 sleeves split across two vendors. For each vendor, test five specimens at two confining pressures (e.g., 10 and 30 MPa). Record install time, wrinkle incidence, low-pressure hold drift, and any weeps or slips. During loading, watch for early “fake stiffness”8—if the curve feels too stiff at tiny strains, the sleeve may be too thick/hard or undersized. Log post-test sleeve condition (edge whitening, mid-span thinning, micro-tears). If two runs tear at the same cap shoulder, it’s probably your edge radius, not the supplier—fix that and retest.

Next, calculate a simple membrane effect index: compare initial tangent modulus against a trusted baseline. If Vendor A runs consistently higher by a fixed small margin but never tears, that may still be acceptable for production—just note the correction. Then evaluate supply: confirm lead time, MOQ, spare inventory, and whether you can reserve a batch during busy seasons. Negotiate a 12-month QC clause: if a batch exceeds agreed thickness SD or swell %, they replace it. Finally, issue a trial-to-production memo with your chosen vendor, sizes, and a reorder cadence. Use my evaluation workbook here and a one-page supply memo template here.

Pilot evaluation table (example)

| Metric | Vendor A | Vendor B | Target |

|---|---|---|---|

| Install time (min) | 6.5 | 7.2 | ≤ 8 |

| Hold drift @0.2 MPa (5 min) | 0.00–0.01 MPa | 0.01–0.02 MPa | ≤ 0.02 |

| Tear rate (10 pcs) | 0 | 1 | 0 |

| Swell in oil (72 h) | +1.5% | +3.2% | ≤ 3% |

| Early stiffness flag | None | Occasional | None |

Conclusion

Buy with a plan: verify specs, test samples, pick two channels, and let calm plots choose your long-term sleeve partner.

-

Understanding these records is crucial for evaluating material quality and ensuring product consistency. ↩

-

This table helps assess material compatibility, which is vital for preventing failures in applications. ↩

-

Understanding a spec sheet is crucial for ensuring product quality and compatibility, making it a valuable resource for your pre-buy process. ↩

-

Finding the right O-ring sizes is essential for preventing leaks and ensuring optimal performance, so exploring this topic can enhance your purchasing decisions. ↩

-

Understanding the two-supplier strategy can enhance your procurement efficiency and risk management. ↩

-

Exploring the advantages of direct manufacturers can help you optimize your supply chain and reduce costs. ↩

-

Understanding pilot batches can enhance your production strategy and improve quality control. ↩

-

Exploring this topic can help you identify issues in material selection and testing processes. ↩